The recent news is eye-opening to know that Google paid $15B to Apple to keep Google as a default search engine on iPhone and Apple devices. As I was curious to know how this works out for Google, I did the required math and understood the Google business better.

$15B for just ONE year!!

Yes, let’s register this first; it’s the value paid for one year only. Last year Google paid $10B to Apple for the same. So the value Google derives out of paying this has to be recovered in one year alone. The below calculation showcases the same.

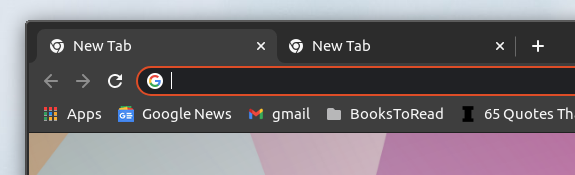

What is a default search engine?

All the modern browsers like Chrome, Safari, Firefox use the address bar as a search box. You type the search keyword and hit enter, and you land up on Google’s webpage with all the ads & search results. As a user, this is the best user experience when they need to find something quickly. When a user installs the browser or buys a new machine, the default search engine is set, and users hardly change this. However, users have the option to change it to other search engines. Who cares to change the default Google search? Only 5% do.

What is Google’s core business, and how much does Google earn from it?

Google’s Annual revenue for 2020 was $181B. Google has many products and services; however, “Search & Ads” is their core business, accounting for 80%. i.e around $145B. Google Cloud, YouTube, and Google’s other bets contribute to the rest of 20%. Thus Google would never want to lose handle over search business and continue to dominate it – at any cost. And Apple knows this very well.

Google’s Total business for 2020 = $181B ($145B from Search and rest from other Google Bets).

The starting point for users to search: The Browser

A few years back, the user had to visit Google.com, wait for the page to load, and type the search query. Time since Chrome brought the feature of searching directly from the address bar; things changed dynamically for Google and other search engines. It saves users time and lets them focus on search. It brought convenience for the users and stickiness to Google. For any business, it’s most important to be present where users are. Make the product available at the right point, and people will start using it and continue so based on the convenience. Google has exactly done this, working closely with all browsers.

Browsers market-share and its business model

Top four browsers Chrome / Safari / Firefox / Edge, contribute to 91% of browser market. Major revenue for browsers comes from royalties from the search business. Apple Safari, as you see, gets $15B from Google. For a 3.5% market share of Firefox, it gets around $450M from Google per year to keep it as a default search engine. Opera, the next line browser to gets around $200M from Google every year. That’s how browsers make business. The more the market share of the browser, the higher will Google pay. Google Chrome and Microsoft Edge keep the revenue within the company.

Mapping Google’s search revenue across browser vendors

Now let’s see each browser contributed to Google’s $145B revenue. Let’s divide this revenue based on browser market-share percentage. Chrome brings 65%; Safari brings 18%; Firefox brings 3.5%. Microsoft Edge does not bring revenue to Google as Bing is the default search engine. Thus around 86.5% of the top 3 browsers contribute to Google’s 100% (almost) of search revenue.

Now Googles Search Engine market share across all search engines is 90%. The rest of 10% goes to Bing, Yahoo, and DuckDuckGo. Considering 5% of Bing’s share comes from Edge, 5% of people use Yahoo, DuckDuckGo, Yandex on Chrome, Safari & Firefox. If we divide 5% across Chrome, Safari and Firefox-based on ratio, we get Chrome = 61.25%, Safari = 17%, Firefox 2.75% users using Google Search.

Thus Chromes 61.25% + Safaris 17% + Firefox 2.75% market share contributes to 100% of Google search revenue of $145B

Mapping browser’s market share to Google’s revenue share of 100%, I could see 75% of revenue comes from Chrome, 21% comes from Safari, and 4% comes from Firefox.

Apple users contribute to 21% of Google Search revenue. 21% of $145B = $30.5B, for this Google is paying Apple $15B. At first glance, Google is still making money and keeping its dominance.

Counting on high-value Apple users to show high-value ads

With the above calculation, we saw Google gets $30.5B from Apple users, which is still a raw value, and we can fine-tune it further.

Apple devices are premium, and people affording them are among the top premium users. Google is getting a handle over premium users and would like to capitalize on it to earn more. Google will surely target high price ads and products to these users. Assuming we say Google gets an additional 30% advantage for premium users, the revenue goes up to $40B.

Thus, to get business of $40B from Apple users, Google pays $15B to Apple. Apple gets 38%, and Google gets 62% from Apple users searching on Google.

Apple launching New iPhone next month and expecting high growth

Next month, Apple is launching a new series of iPhones (Sep 2021) and manufacturing 90M devices, much higher than last year’s 70M. A good few people will migrate from Android to iOS, thereby growing the market-share for Safari. Increasing the market share of Safari by even 1% (i.e., 18% to 19%) will make a $1-2B shift in revenue for Google.

What does User-Acquisition-Cost mean?

Using Product terminology ‘User Acquisition Cost’ and how it’s related to this topic. It costs to acquire the user by marketing campaigns, calls, ads, and other activities. This cost is calculated based on the amount paid for the marketing campaign divided by the number of users acquired. In this case, let’s consider $15B as the cost paid to acquire users for Google Search and Ads.

Google makes money based on ads shown per query and not per user. So let’s go granular here at the search-query level and not at the user level. Let’s make this metric ‘User Search Query Acquisition Cost’ and calculate its value for the Apple deal.

User Search Query Acquisition cost = ($15B / Total number of search queries in one year on the Apple devices)

Data shows, there are 5.5B queries per day on Google. So search queries for a year = 5.5B x 365 days = 2 Trillion queries per year from ALL users (not just from Apple devices)

In the above section, we say 21% of users are Apple. So 21% of 2 Trillion search queries = 420 Billion search queries per year from Apple users/devices.

User Search query acquisition cost = ($15B / 420 Billion search queries from apple devices) = $0.035c per search query.

Revenue generated out of these search queries from Apple Devices = $40B / 420B Search queries = $0.1c

Google pays $0.035c to Apple to earn $0.1c per search query.

What choices does Apple have?

Practically saying, none other than Google – Closest is Bing. However, looking at Bing’s annual revenue of $7.7B, it will be a big bet for Microsoft to pay more than $15B per year to Apple and then try to grow from $7.7B to $20B+.

A remote option could be to make DuckDuckGo a default search engine. DuckDuckGo is a privacy-focused search engine and aligns well with Apple’s privacy thought process. Apple already had integrated this and rollout in some regions. While DuckDuckGo can’t pay more than $15B as they are a $1B company today. Alternatively, Apple could acquire DuckDuckGo and make them a default search engine. By this, Apple can grab the entire $40B search business generated out of Apple users. Not a bad option for Apple; however, it’s still a bet as DuckDuckGo is not a popular search engine. Google provides better results to users because they have user’s data to provide more relevant ads.

Apple took the safest option to go with Google and earn $15B, which counts to 4-5% of Apple’s revenue!

What could be Microsoft’s take on this?

Microsoft owns their browser, Edge, and search engine Bing which is the default on Windows OS. On Desktop/Laptop Windows has a significant market share of 75% as per statistics report. All new laptops/desktops with Windows have ‘Microsoft Edge’ as the default browser, which comes with ‘Microsoft Bing’ as a default search engine. More the Windows market share, more the Edge market share, and thus more the Bing usage moving forward. Microsoft Edge will always go with the Microsoft Bing search engine to capture search/ad business and increase it from $7B to more. This is still a sustainable model for Microsoft to invest and grow and not burn money by paying Apple for grabbing the default search engine on Apple devices.

To summarize

- Google’s projected annual revenue from search & ads is $145B.

- Annual search revenue coming from Safari as a browser is around $40B.

- Apple gets 38% search revenue and makes $15B, and Google keeps $25B at 62%

- Google maintains its dominance over search business.

- Users get the best search results out of the box.

Please note that there are some assumptions made here. Also, I am not counting Opera, Brave, Samsung browsers. Also, I am counting guestimated 30% revenue from apple user’s premium users. For simplicity, I have rounded some numbers too.

We’d love to hear from you – Submit a feedback!

Mangesh is Product Leader

Full Bio here – https://mangesh.bhamre.in